Your cart is currently empty!

Maintaining a Stable Business: Why It’s Harder Than It Looks

Running a business is often portrayed as glamorous. People see the freedom of entrepreneurship, the pride of being one’s own boss, and the financial opportunities that come with it. But what most don’t see are the long nights, the stress of uncertainty, and the countless hours spent just keeping things steady. Growth grabs headlines, but stability is what separates businesses that last a few years from those that thrive for decades.

Business stability is not about standing still—it’s about creating a reliable structure that can adapt while remaining steady. It requires continuous planning, thoughtful decision-making, and the discipline to weather both economic storms and internal challenges.

The Hidden Weight of Stability

At its core, stability means predictability. A stable business is one where:

- Revenue can be forecasted with some accuracy

- Customers return regularly instead of sporadically

- Operations don’t break down when demand shifts

- Employees feel secure and motivated

- Risks are managed instead of ignored

But stability doesn’t just “happen.” It’s the product of thousands of small, often invisible, decisions. For example, while the public might see a product launch as a sign of success, the behind-the-scenes work—ensuring there’s enough capital to produce, that suppliers are reliable, and that customers will be supported—makes or breaks that success in the long run.

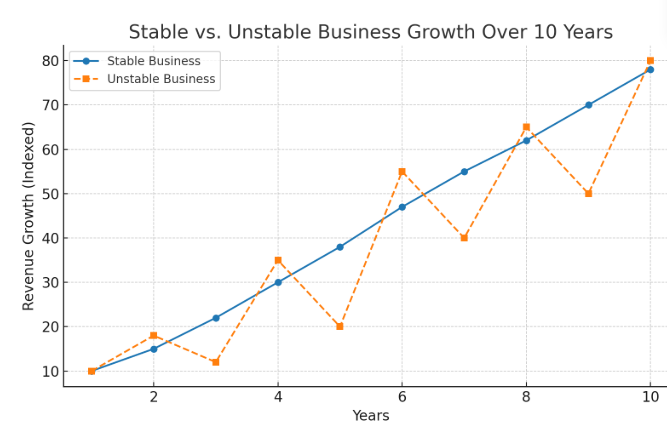

The line graph we saw earlier comparing stable vs. unstable businesses illustrates this point perfectly. The stable line rises steadily. It might not spike as dramatically, but it shows progress without collapse. The unstable business, meanwhile, surges and falls unpredictably—sometimes outperforming, but at the risk of sudden failure.

Why Planning Is the Backbone of Stability

Planning is one of the least exciting but most critical aspects of business stability. Without planning, even a profitable business can crumble. For example, rapid growth without financial planning can lead to cash shortages, where a company sells more but can’t afford to fulfill orders.

Key forms of planning include:

- Financial Planning: Ensuring cash reserves exist for downturns, forecasting income vs. expenses, and controlling debt.

- Strategic Planning: Anticipating market changes and positioning the business to remain competitive.

- Operational Planning: Creating workflows that minimize errors and reduce costs.

- Crisis Planning: Having “what-if” scenarios for supply chain disruptions, competitor threats, or economic slowdowns.

Each of these is not a one-time task—it’s ongoing. For instance, financial planning requires constant monitoring of cash flow, adjusting budgets, and reevaluating investments.

The Hardest Challenges in Staying Stable

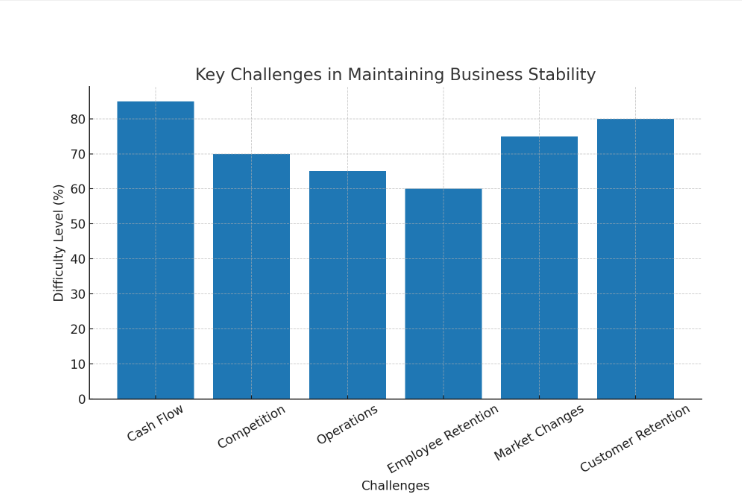

While every business faces unique obstacles, certain challenges are nearly universal. The bar graph below illustrates some of the biggest hurdles entrepreneurs cite when trying to keep their companies steady.

- Cash Flow (85%) – A business can be profitable on paper but still collapse if money isn’t available at the right time. Late payments, high upfront costs, and seasonal fluctuations all make this the hardest challenge.

- Competition (70%) – Competitors can undercut prices, innovate faster, or capture attention, forcing businesses to constantly adjust just to keep pace.

- Operations (65%) – Inefficient processes waste money and time, which over time erode stability.

- Employee Retention (60%) – High turnover disrupts operations and increases training costs. A stable workforce is essential for a stable business.

- Market Changes (75%) – New technology, shifting customer needs, or sudden global events can disrupt even the strongest companies.

- Customer Retention (80%) – Acquiring new customers is expensive; without loyalty, stability is nearly impossible.

The bar chart shows that cash flow and customer retention are the two most pressing issues. Even if a business has great products and loyal employees, if customers don’t keep buying—or if money isn’t flowing when it’s needed—stability will be short-lived.

Stability Is Not the Same as Stagnation

A common misconception is that focusing on stability means avoiding change. In reality, stable companies are often the ones most willing to adapt carefully. They innovate in controlled ways, making sure new initiatives don’t compromise their foundation.

For example, a stable company might roll out a new product line only after ensuring its supply chain can handle demand. An unstable company might rush the launch for short-term profits and later find itself unable to deliver consistently.

Stability means balancing innovation with caution. It’s about saying, “Yes, we will grow, but not at the cost of risking collapse.”

The Long-Term Perspective

Perhaps the hardest truth about stability is that it doesn’t offer instant gratification. A founder might work tirelessly for years, not to achieve massive growth, but just to create a business that operates consistently. This can feel unrewarding when others seem to be skyrocketing overnight. But over the span of decades, steady stability outpaces risky surges almost every time.

In fact, many iconic brands—those that have survived recessions, technological revolutions, and global crises—owe their success not to spectacular short-term growth but to their commitment to long-term stability.

Final Thoughts

Stability in business is one of the most underappreciated achievements. It’s not flashy, and it doesn’t always make headlines, but it’s what allows companies to last through unpredictable markets and build real legacies.

To maintain stability, entrepreneurs must:

- Accept that it requires constant work

- Invest in planning and risk management

- Focus on both growth and retention

- Build systems that can withstand external shocks

It’s tempting to chase rapid expansion or quick wins, but the businesses that stand the test of time are those that prioritize balance. Stability is not the absence of growth—it’s the foundation that makes growth sustainable.

Leave a Reply